How to quickly navigate Australia's new merger review laws: what you need to know

Australia is transitioning from a voluntary merger notification regime to a mandatory and suspensory notification regime. The new regime will formally commence on 1 January 2026 but is available to merger parties on a voluntary basis from 1 July 2025.

The changes represent the most significant reforms to Australia's merger settings in almost 50 years. They are intended to bring Australia in line with comparable OECD jurisdictions by requiring significant acquisitions to obtain merger clearance prior to completion.

The changes have been introduced to address perceived shortcomings with the current voluntary regime, including: failures to notify the competition regulator of potentially anticompetitive acquisitions; information asymmetries between the competition regulator and merger parties; concerns surrounding 'creeping' or 'serial' acquisitions; and acquisitions by incumbents of nascent competitors.

Under the new regime, acquisitions of shares or assets that are connected with Australia and that meet certain value thresholds must be notified to Australia's competition regulator, the Australian Competition and Consumer Commission (ACCC), and will be published on the ACCC's Acquisitions Register.

An acquisition of shares or assets is connected with Australia if it is in the capital of a body corporate that carries on business in Australia. An acquisition of an asset is connected with Australia if it is used in, or forms part of, a business carried on in Australia. It is possible for a corporation to carry on business in Australia even if it is not incorporated in Australia and even if it has no physical presence in Australia.

An acquisition that is required to be notified to the ACCC under the new regime is automatically stayed and is not permitted to be 'put into effect' until it has been considered (and approved) by the ACCC. If an acquisition is put into effect while stayed, it is void unless ordered otherwise by the Federal Court of Australia. The ACCC may determine that the application must not be put into effect if it is satisfied that the acquisition would have the effect or likely effect of substantially lessening competition in any market.

The concept of 'putting an acquisition into effect' is a broad one and does not require legal ownership to have changed. For example, an acquisition may also be put into effect by terminating the employment of key employees, closing key facilities, or integrating IT systems. Merger parties will need to carefully examine their pre-completion activities to ensure that those activities do not inadvertently amount to putting the acquisition into effect prior to obtaining ACCC approval.

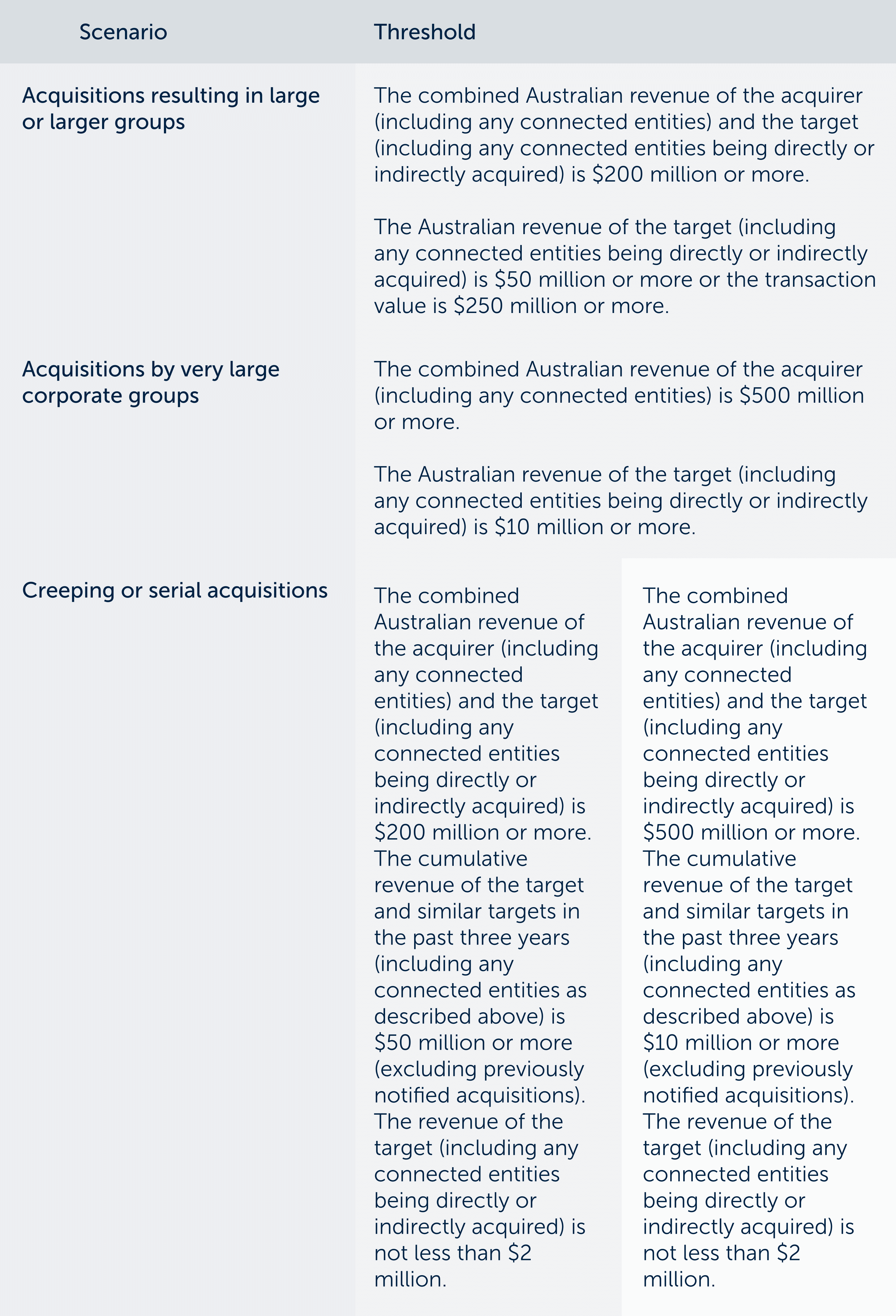

1. Notification thresholds

The following notification thresholds apply to acquisitions under the new regime:

In addition to these general thresholds, specific rules apply to acquisitions by Australia's supermarket incumbents, Woolworths and Coles, or their related bodies corporate.

The Government retains the power to make regulations for new notification thresholds, including thresholds based on the level of concentration in a market (for example, the specific regulations that apply to Woolworths and Coles were driven, in part, by their 67 per cent market share and absence of rivals of comparable scope and scale).

2. Exemptions

There are a small number of exemptions to the new regime. Broadly, the following categories of acquisitions are not required to be notified under the new regime:

- acquisitions that are part of a restructure or reorganisation of related bodies corporate (within the meaning of section 4A of the CCA) or other persons that are related by means of trust or partnership;

- acquisitions of legal or equitable interests in land:

- for the purpose of developing residential premises or for certain commercial property acquisitions;

- if the acquisition is an extension or renewal of a lease for the land;

- where the same acquirer had previously notified the ACCC of an acquisition of an equitable interest in the same land (for example, in relation to a single land acquisition that takes place in multiple stages);

- if the acquisition relates only to a sale and leaseback arrangement relating to the land;

- acquisitions of interests in land in the form of land development rights (where the substance of the transaction is equivalent to a land acquisition that would otherwise be exempt from the notification requirements);

- acquisitions by a person in the person's capacity as an administrator, receiver, receiver and manager, or liquidator (but, for the avoidance of doubt, this exception does not apply to acquisitions from such a person);

- acquisitions made by an operator of a clearing and settlement facility acting in that capacity, or by a participant in such a facility acting in that capacity and for, or on behalf of, another person who is a party to the acquisition;

- acquisitions of shares or assets that occur as a result of the exercise of a contractual close out right, set-off right, or right of combination of accounts (except where the acquisition results in control of a body corporate or the acquisition of all, or substantially all, of the assets of a business);

- various acquisitions relating to financial securities, debt instruments, money lending, financial accommodation, and security interests; and

- acquisitions that occur by operation of law (for example, the vesting of a deceased person's property in the executor of their estate).

Where there is doubt about whether a particular exemption applies, businesses are able to apply to the ACCC for a waiver (that is, a determination that the acquisition is not required to be notified to the ACCC under the new regime).

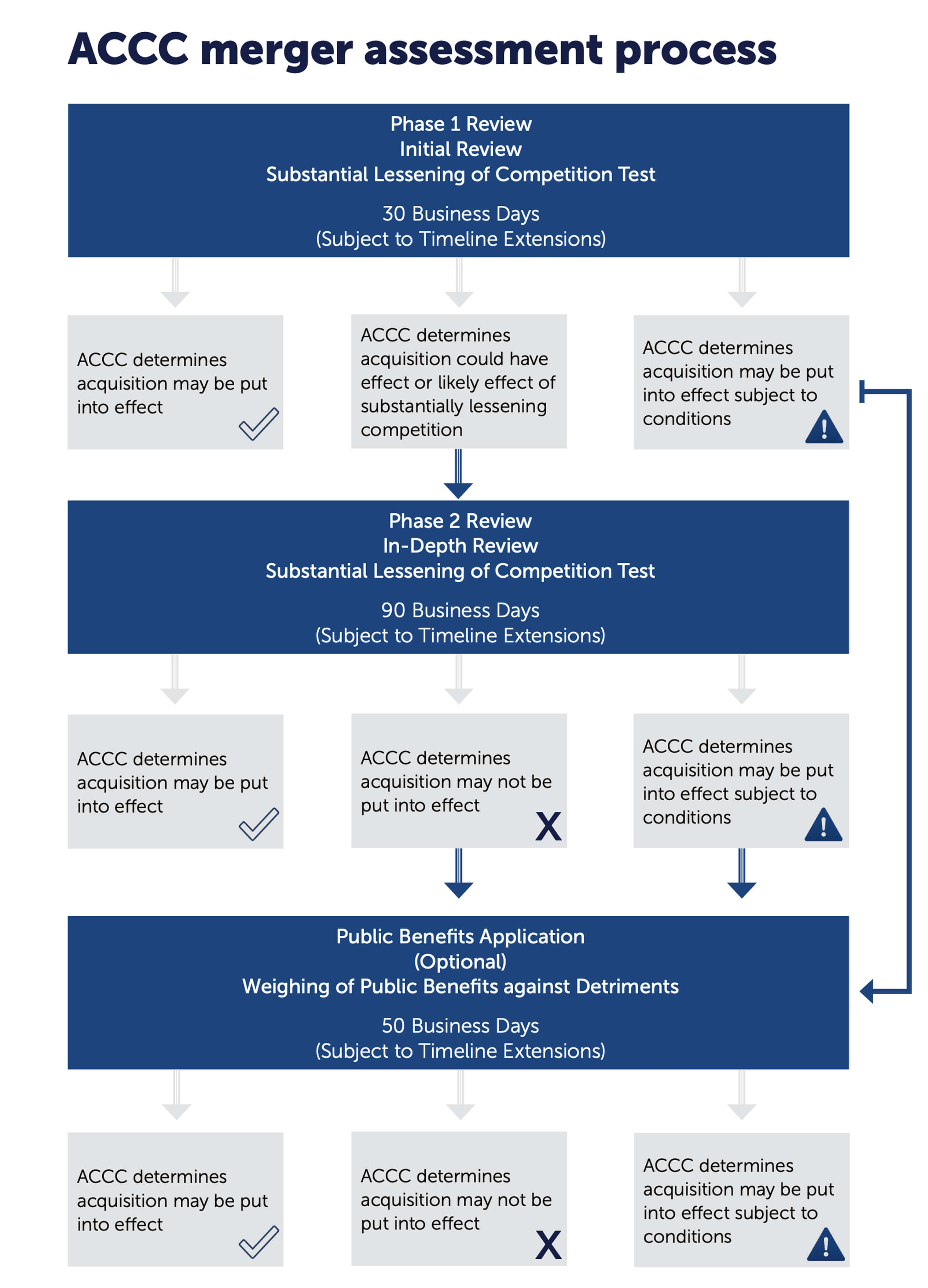

3. Stages of merger review

Under the new regime, an acquisition that is required to be notified to the ACCC may progress through up to three formal phases of merger review.

These stages of merger review comprise: an initial review; an in-depth review (where competition concerns are identified); and, optionally, a public benefits assessment (where competition concerns are identified but are potentially outweighed by the public benefits of the acquisition):

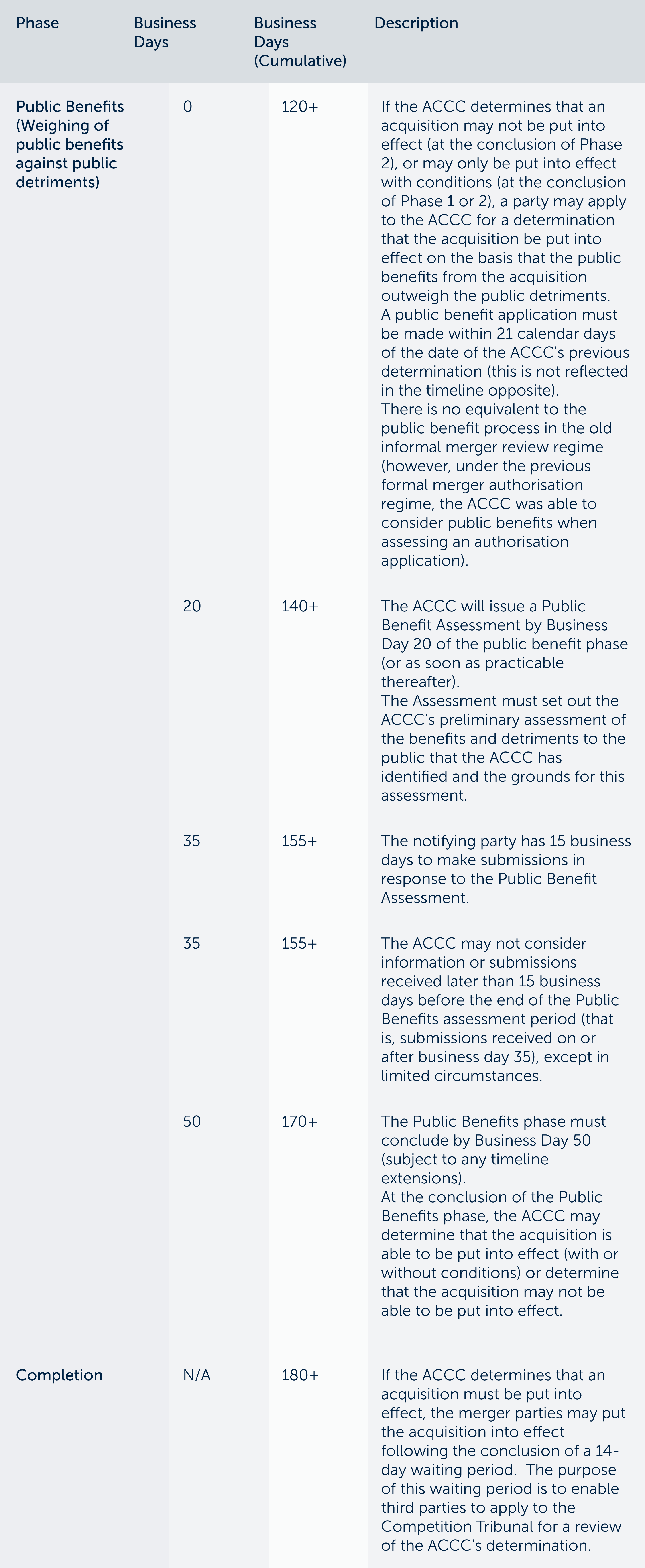

4. Timelines

The following timelines apply to notifications under the new regime. These timelines may be extended in certain circumstances:

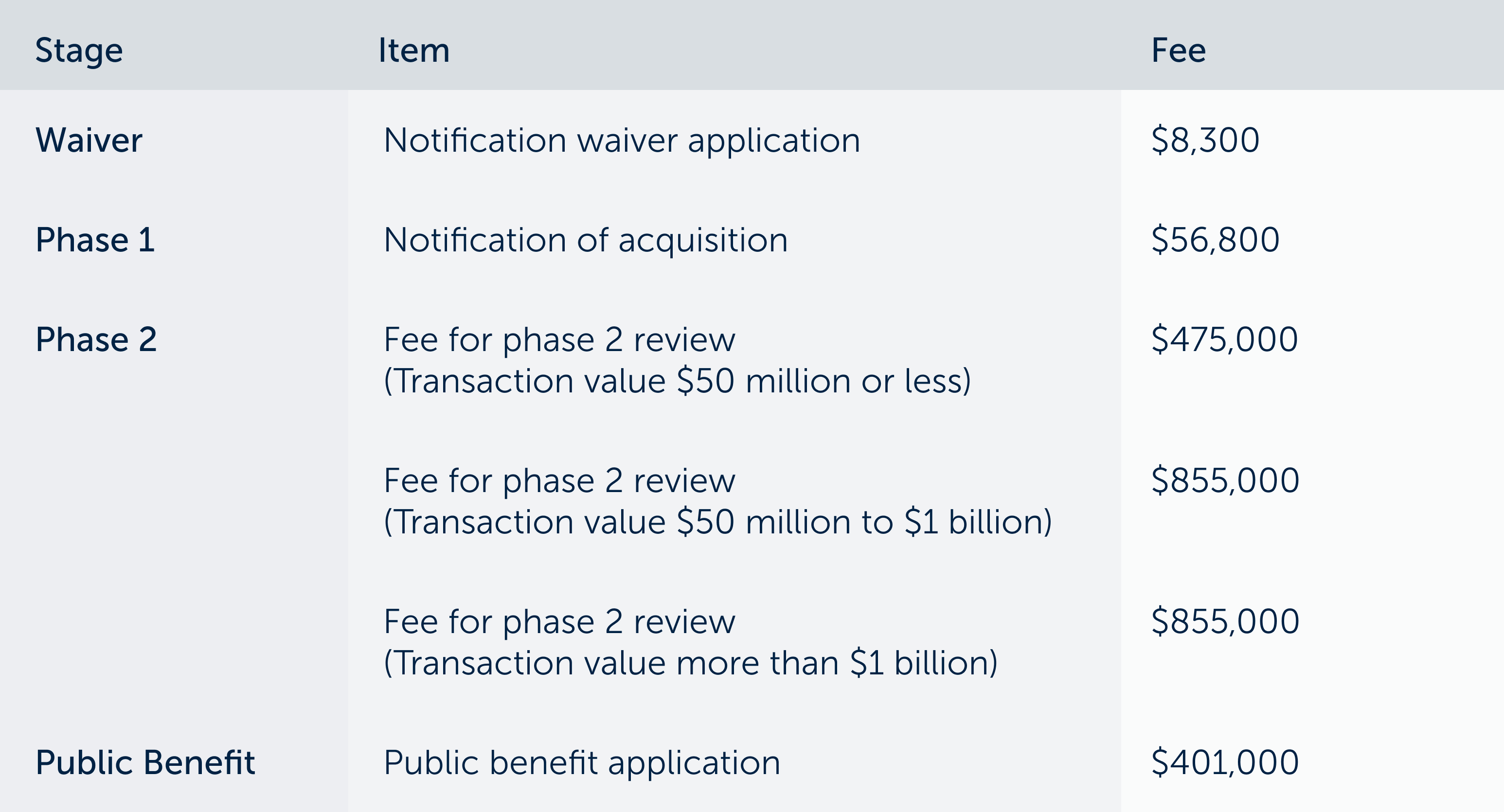

5. Fees

The following fees apply to merger notifications under the new regime. There is a fee exemption available for 'small business entities' as defined in the Income Tax Assessment Act 1997:

6. Review by Australian Competition Tribunal

If a party is unsatisfied with an ACCC determination under the new merger regime, it may apply to the Australian Competition Tribunal for limited merits review of the ACCC's determination. Except in limited circumstances, the Tribunal may only have regard to information that was before the ACCC during the ACCC's assessment of the notified acquisition.

7. Foreign Investment Review Board

The new merger review regime operates independently from Australia's foreign investment review framework as described in the Foreign Acquisitions and Takeovers Act 1975. However, both regimes involve an assessment of the impact of the acquisition on competition.

As part of the foreign investment review process, parties are required to indicate whether their acquisition will be notified to the ACCC and Treasury may refer particular acquisitions to the ACCC for competition assessment.

Where an acquisition is notifiable under the new merger review regime, and also subject to Foreign Investment Review Board (FIRB) approval, parties will need to carefully consider the timing of any ACCC notification and FIRB application. The sequencing of these actions is likely to turn on an assessment of the likely competition concerns and/or national interest concerns that may apply to a particular acquisition. For acquisitions that are notifiable, but do not raise any meaningful national interest concerns, it is likely to be preferable for parties to notify the ACCC in advance of commencing any FIRB process.

8. Impact on transaction timelines

The new merger review regime may cause delays to future transaction timelines, particularly for acquisitions that meet the notification thresholds but do not otherwise raise meaningful competition concerns.

- By way of example, under the current informal merger review process, such acquisitions would be capable of being pre-assessed by the ACCC within approximately two weeks (and, where parties were highly confident that no competition issues arose, could be completed without seeking ACCC approval).

- Conversely, under the new regime, such acquisitions would be required to be notified to the ACCC. The ACCC would, in turn, be prohibited from making a determination in respect of the acquisition until 15 business days after the notification date of the acquisition. The merger parties would then need to wait a further 14 days before putting the acquisition into effect (in order to enable the review period for the ACCC's determination to expire).

The effect of the above is that, under the new regime, ACCC clearance will effectively require a minimum of approximately 35 days compared to 14 days under the old regime. It is therefore important for merger parties who consider that notification may be required to engage with the ACCC as soon as possible, particularly for time sensitive transactions.

9. Existing acquisitions

Under the previous (voluntary) merger review regime that applied in Australia, merger parties had the option of applying to the ACCC to authorise a proposed acquisition (a formal process under the Competition and Consumer Act 2010) or alternatively seeking informal merger review of the proposed acquisition (an administrative informal process not underpinned by legislation).

As a result of the new regime, parties are no longer able to apply for merger authorisation. Until the new regime formally commences on 1 January 2026, parties continue to be able to apply for informal merger review. However, if the ACCC does not provide informal clearance by 31 December 2025, and the acquisition meets the notification thresholds specified above, it will need to be (re)notified to the ACCC under the new regime (causing delays to completion). The ACCC has indicated that mergers that are voluntarily notified to the ACCC under the existing informal merger review regime from October 2025 onwards risk not being considered in time.

Practically, based on the ACCC's public merger review data, merger parties should assume that there is a risk any mergers notified on or after 1 July 2025 may not be assessed in time if they are subject to public review by the ACCC. By way of example, in the period between 10 April 2025 and 4 July 2025:

- the ACCC assessed 10 public informal merger reviews;

- of these 10 reviews, all but one would have not been assessed in time had they been notified on or after 1 October 2025; and

- five of the reviews conducted by the ACCC (50 per cent) would not have been assessed in time if they had been notified at any time on or after 1 July 2025.

The effect of the above is that merger parties should carefully consider whether or not to apply for informal merger review in the transition period leading to the formal commencement of the new regime. In some cases, it may be preferable for parties to voluntarily notify under the new regime if there is a risk of public review under the informal merger review regime.

10. Acquisitions that fall under the notification threshold

Acquisitions that fall under the notification thresholds described above are not required by law to be notified to the ACCC. However, the ACCC retains the ability to investigate these acquisitions if the ACCC is concerned that they may contravene the Competition and Consumer Act 2010.

The ACCC has the ability to investigate acquisitions that fall under the notification thresholds before or after those acquisitions complete and may (in some circumstances) commence proceedings seeking injunctions preventing acquisitions from completing or penalties and orders for divestiture where an acquisition has completed.

In light of the above, even if an acquisition falls under the revenue thresholds outlined above, merger parties should still actively consider whether the acquisition should be voluntarily notified to the ACCC.

For more information or assistance, please contact our Competition and Regulation team.

%402x.svg)

%402x.svg)

.svg)